Handling Taxes (Intermediate)

First thing's first, I am not a financial adviser and cannot give you any legal advice.

I do not consider myself an expert in this field at ALL. However, since lots of people have asked tax questions, I'm putting this here in an effort to help.

Carl put it beautifully when he said:

"This is an area best addressed by consulting a professional tax advisor rather than a marketing training course. Here is a link to a service that does have a lot of professional tax advisors who have written a lot of good articles on the subject."

Also, if you are in the USA then check out this module about an awesome tax deal I got you.

General Taxes

We had an open Q+A thread with a tax expert on Facebook.

You can read through the questions and answers right here, and the answers are current as of April 2018.

Amazon Taxes

This post is a great article on Amazon F.A.Q.

And if you're wondering about state taxes, as of April 2018 Amazon will collect sales tax for us in every state. They file it with the state themselves in PA and WA, since those are the states with the automatic tax rules.

GearBubble Taxes

If you're from USA, you will need to fill out a W-9 to get paid.

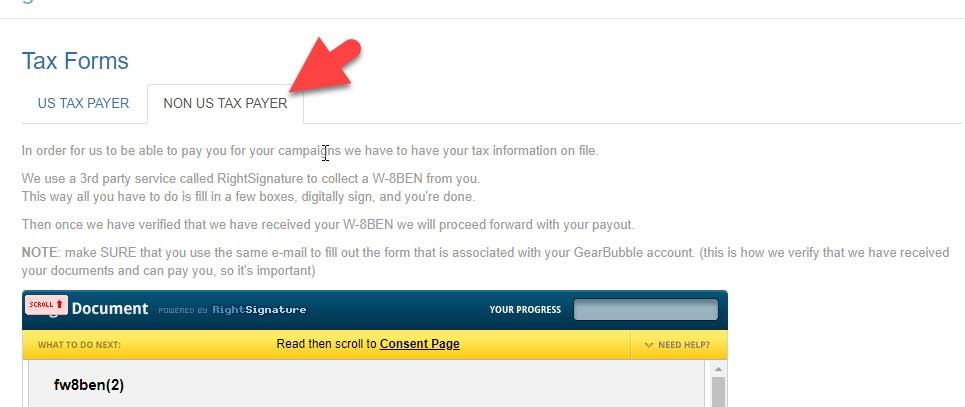

If you're NOT from USA, click on the 'Non US Tax Payer' image (thanks Carl!) and fill out the forms there.

International Taxes

We've had a few threads on this. Erica said: "Trying to put this into as little words as possible: if you have no home, no office, and no warehouse inside the USA, and you do not use FBA (=send mugs to Amazon's warehouse), you owe no sales tax at all inside the US. Only income tax in your own country." You can find more discussion in that thread.